2025-2026

Benefits at a Glance

My Medical Benefits

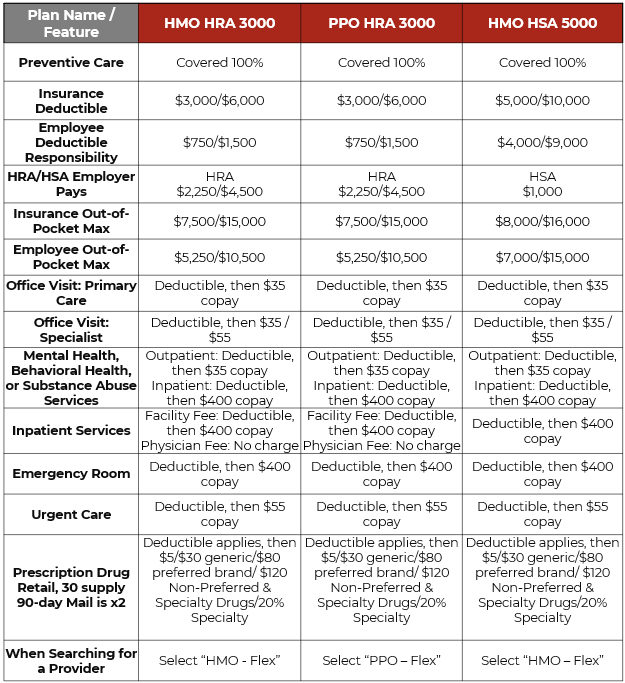

The Newman School offers employees three medical plan administered by Harvard Pilgrim. The two HRA plans, as seen below, are unchanged from last year. The third HSA plan is a new offering for the 2025-2026 plan year. Please see below for an outline of coverage.

Summary of Benefits & Coverage (SBC’s)

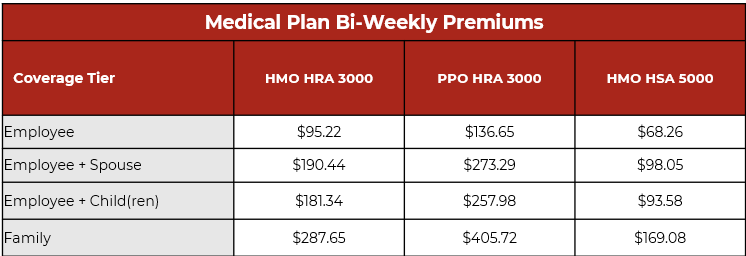

Contributions

Eligibility

Employees working more than 20 hours a week are eligible on their date of hire.

Wellness Initiatives

Forms and Plan Information

Discount Programs for Weight Loss

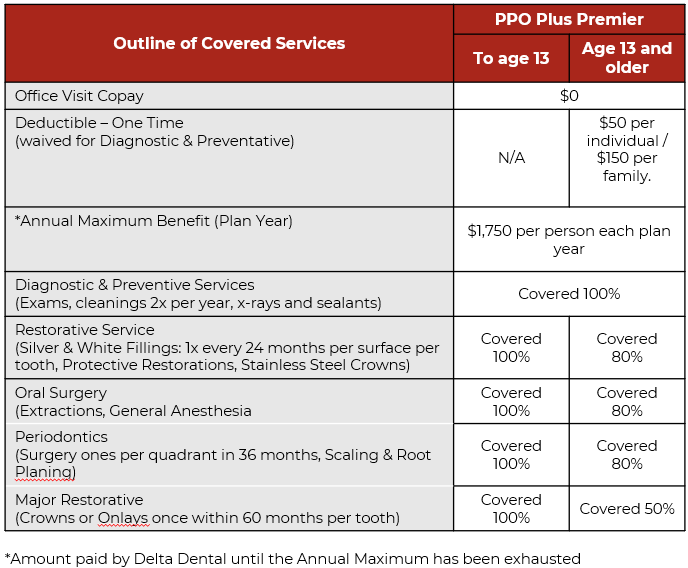

My Dental Benefits

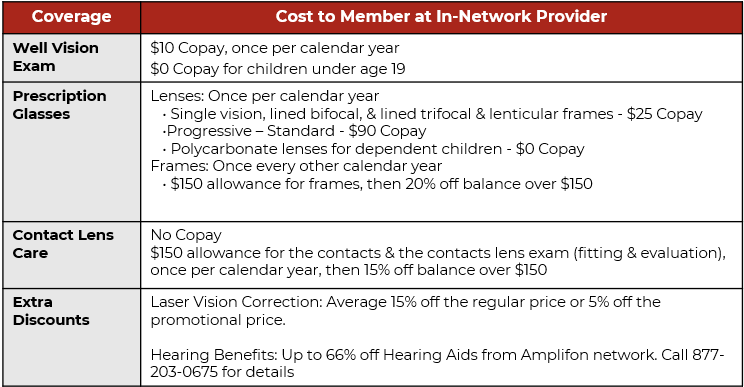

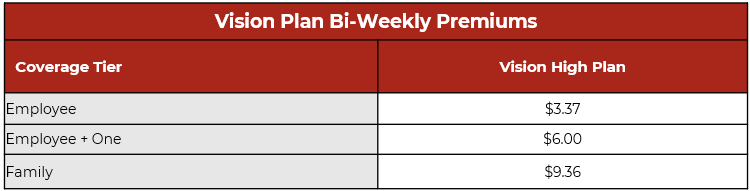

My Vision Benefits

My Health Savings Account Benefits

Employees who enroll in the HMO HSA 5000 medical plan will have a health savings account set up and administered by Flores in their name.

An HSA is an individually owned account that is paired with HSA-qualified health plans into which an employer and employee may make pre-tax contributions.

Balances earn tax-free interest and can be paid out tax free for qualified medical, dental, vision and other expenses now and into the future.

You can use your HSA to pay for current health expenses, including your deductible and out-of-pocket costs that your medical, vision, and dental insurances may not cover, or you can save your funds for future medical needs, such as:

- Health insurance or medical expenses if unemployed

- Medical expenses after retirement (before Medicare)

- Out-of-pocket expenses when covered by Medicare

- Long-term care expenses and insurance

Employer Contributions

The Newman School will make monthly deposits into your HSA account in the amount of $83.33 per month, to a total of $1,000 per plan year.

Employee Contributions

Employees may elect to make additional pre-tax contributions through payroll deduction up to the current year’s IRS limits. In 2025 those limits (a combination of employee and employer funding) are $4,300 for individual coverage and $8,550 for coverage with dependents. Since The Newman School also contributes $1,000 each year, the employee contribution max is $3,300 for individuals and $7,550 for coverage with dependents.

Employees age 55+ may also make a catch-up contribution of $1,000. Employees may change their HSA payroll contribution when needed.

My Health Reimbursement Account Benefits

Health Reimbursement Account (HRA) are employer-funded group health plans from which employees are reimbursed tax-free for qualified medical expenses up to a fixed dollar amount per year.

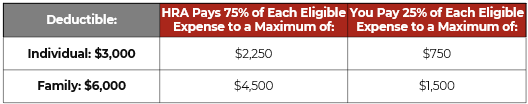

The Newman School generously offers an HRA to assist employees with deductible-eligible expenses. The HRA applies to the PPO & HMO HRA plans, and you are automatically enrolled when you enroll in one of these two plans.

The HRA is administered by Flores, which will automatically reimburse you for 75% of each claim/deductible expense that you incur. No action is required from you to activate the benefit.

HRA funds unused at the end of a plan year will be forfeited.

Once you have met your Individual / Family deductible for the year, you will be responsible for paying applicable copays for the remainder of the year. The HRA covers Medical and Prescription Deductible expenses only.

My Flexible Spending Account Benefits

An FSA is an annual election whereby an employee can elect to make pre-tax contributions to:

General Medical Reimbursement Account

You may use your contributions to pay for unreimbursed/uncovered medical, dental and vision expenses. This is the plan to be used if you enroll in the HMO 3000 or PPO 3000 plan or if you are insured under another plan that is NOT a qualified, high deductible health plan. Maximum contribution amount is up to the IRS maximum, which for 2025, is $3,300.

Dependent Care Account (DCA)

Dependent Care Accounts are a pre-tax benefit account used to pay for eligible services, such as preschool, summer day camp, before or after school programs, and child or adult daycare. DCA funds are available as they are deducted from pay. DCA funds not used in the plan year in which they were deducted from your pay are forfeited.

Maximum salary reduction:

- $5,000 for single employee or a married employee filing combined tax return

- $2,500 for a married employee filing a separate tax return

Informational Documents

FSA/HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

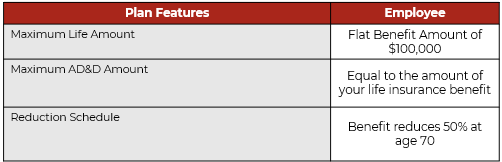

My Group Life and AD&D Benefits

Life insurance offers you and your family important financial protection. The Newman School provides benefits eligible employees with Life Insurance and AD&D coverage.

Contributions

Contributions are 100% Employer Paid.

Eligibility

Employees working more than 20 hours a week are eligible on their date of hire.

My Disability Benefits

The Newman School provides eligible employees with both short-term & long-term disability coverage at no cost to you!

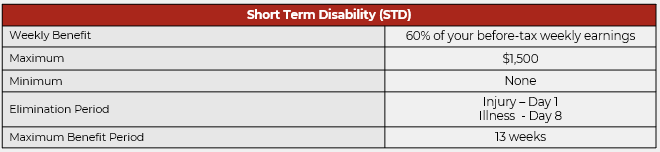

Short Term Disability (STD)

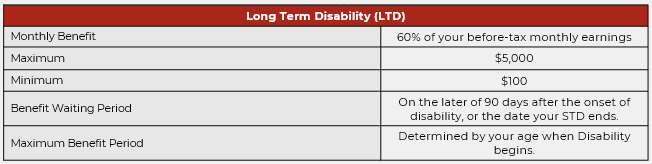

Long Term Disability (LTD)

Contributions

This plan is 100% Employer Paid.

Eligibility

Employees working more than 20 hours a week are eligible on their date of hire.

My EAP Benefits

The Newman School provides all employees with an Employee Assistance Program (EAP) through Mutual of Omaha. EAP is a voluntary, confidential service that provides professional counseling and referral services designed to help with personal, job or family related problems.

EAP consultants are available 24 hours a day, 7 days a week, 365 days a year. Any services provided by the EAP counselors are at no charge to you or your family members.

In addition to phone-based help, a lot of information can be found online, such as featured articles relating to family & relationships, financial wellness, emotional well-being, and much more!

EAP Counselors can provide a solution-focused approach by assessing individual needs and providing appropriate resources and referrals. Some of the issues where EAP can help include:

- Family and relationships

- Emotional well-being

- Financial wellness

- Substance abuse and addiction

- Legal assistance

- Grief and loss

- Work and career

- Change and transition

Contributions

This is 100% Employer paid.

Eligibility

All Employees are eligible upon date of hire.

Helpful Links

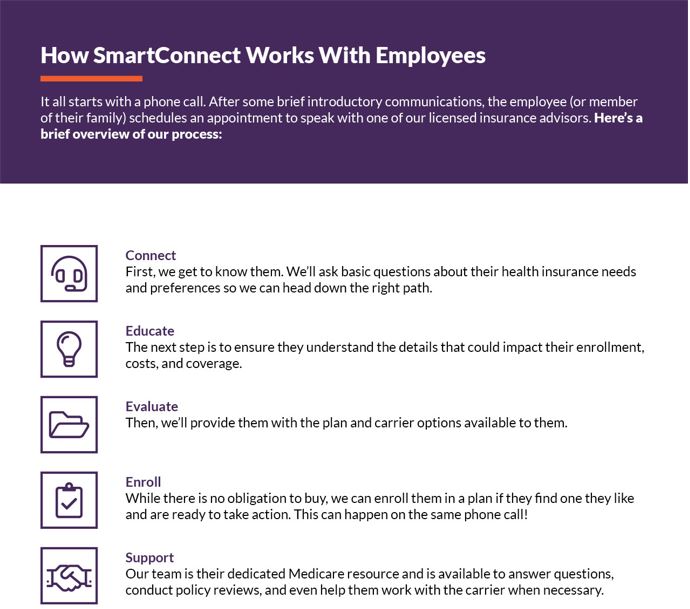

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

Forms and Plan Documents